This is an important question if you are looking for financing for your business or even personally. In this month’s blog we would like to help entrepreneurs and business owners better understand how lenders evaluate businesses that apply for loans.

It is important to note that although each lender evaluates loan applications differently, all lenders use the 5 “C”s of credit as the basis of their credit decision. Lenders need to assess your risk as a borrower; in other words, they want to know that you can pay back the loan.

The 5 “C”s of credit are Capacity, Capital, Collateral, Character, and Conditions. Let’s get into the details.

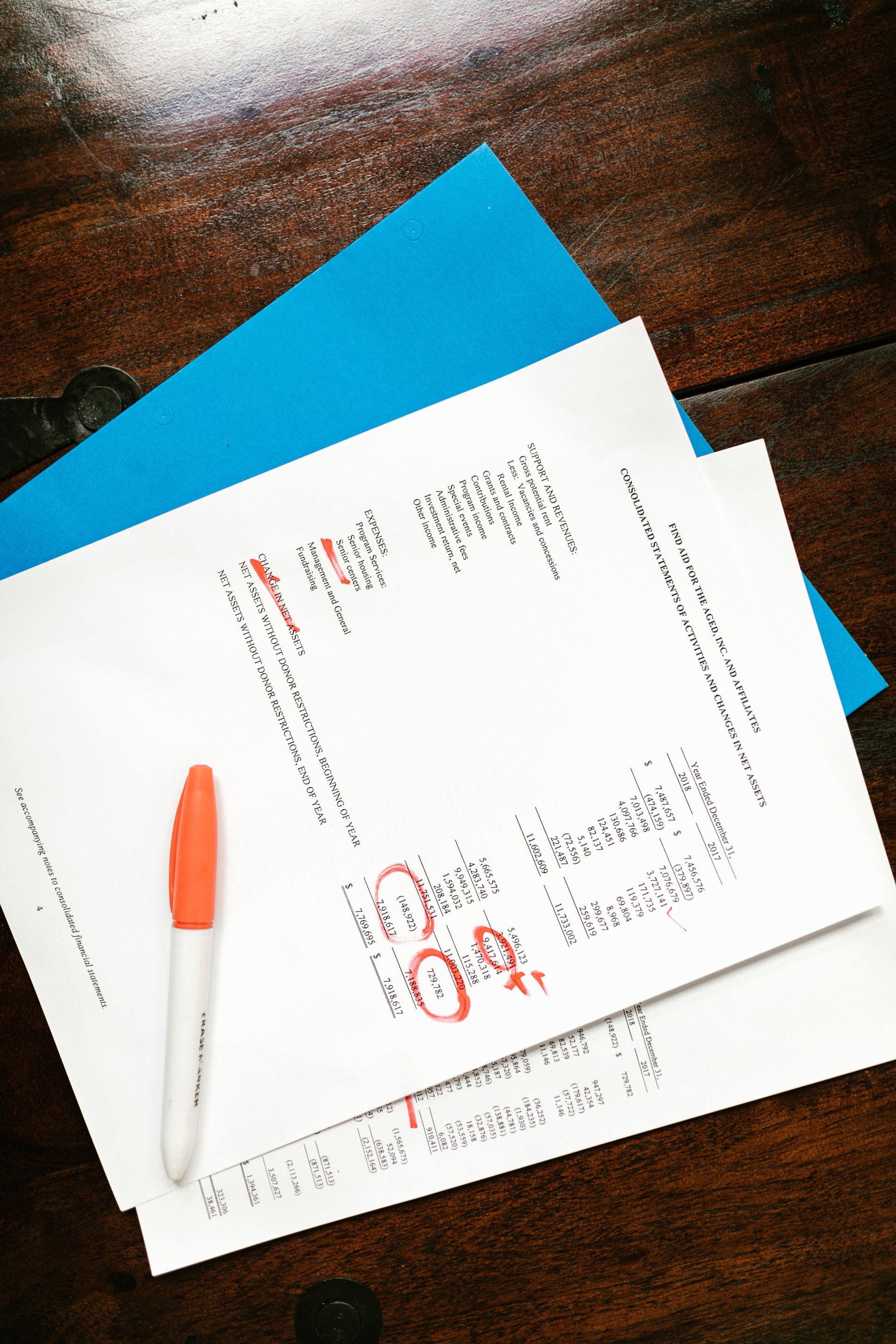

Capacity – This is the businesses ability to repay the loan. Lenders will look at revenue, expenses, cash flow and repayment timing as well as business and personal credit scores. If you are starting a new business, most lenders will look at the global cash flow – your current personal income as well as your projected income from the business. If you are already in business, or are purchasing an existing business, the lender will want to see financial statements from the last three years reflecting positive cash flow and profits, which can include previous year’s tax returns, income statements, and balance sheets.

Capital – Capital is also referred to as equity injection. This is your “skin in the game”. Most lenders will not fund your business at 100%; this means that you will have to contribute cash towards the business expenses. Your investment in the business can be cash from bank accounts, or perhaps funds raised from liquidating investments or bringing on a business partner. This is a deal breaker for most lenders. They will understand, based on your investment, how serious you are about your business.

Collateral – Collateral provides lenders with a secondary source of repayment. If the business stops making its loan payments, lenders can seize collateral to recover some of its losses. Collateral can be equipment, real estate, vehicles, or inventory. In many cases a lender will place a UCC (Uniform Commercial Code) filing on all business assets (ABA); this means that the lender can take any and all assets to cover the amount they lent to the business. If the business assets are insufficient to cover loan amount, collateral can extend to personal assets, such as an owner’s personal residence, since in most cases owners are required to personally guarantee the loan.

Character – Character investigates who you are as a borrower. Your educational background, business and industry experience and personal credit history. In addition, lenders can look at any criminal charges and even delinquent child support. They may ask: What experience do you have running a business? Have you successfully managed profits and losses? How long have you been in the current industry? All these questions are asked in an effort to assess your character as a business owner.

Conditions – Conditions are outside forces that can impact the business such as the industry, economic conditions, technology, and competition. You should be prepared to demonstrate that there is a market for your business and a clear purpose for the loan.

So why do these 5 “C”s of credit matter? Why are they so important? The short answer is that they determine your creditworthiness as a borrower. Banks and other lenders take risks in lending money to people and businesses and need a way to determine how significant that risk is. Additionally, most lenders don’t want to put their business (and personal) customers in a position to fail. What if your loan payment is too high and you can’t pay your monthly expenses? How much debt is too much? These questions and more help lenders determine a borrower’s need for and ability to repay a loan.

Now that you understand what the 5 “C”s of credit are, you may be wondering what you can do to improve your credit position, so here are some tips.

- Make all of your payments on time, both for your personal and business credit, and try to keep your credit utilization (which measures how much credit you’re using) low.

- Apply only for credit you need. Lower debt-to-income ratios (DTI) can help show lenders that you have the capacity for a new loan payment.

- Increase your savings and cash on hand. This improves how your assets look on paper and demonstrates that you can repay the loan. This also shows that you have capital for an equity injection – “skin in the game”.

- Be aware of changes in the economy and your industry that can affect your profit margins.

- Keep consistent and accurate financial statements to help prove your cash position and creditworthiness.

Keep the 5 “C”s of credit and these tips in mind as you work towards your personal and business financial goals. Showing a history of responsible credit use can put you in a better position to get the financing you need!